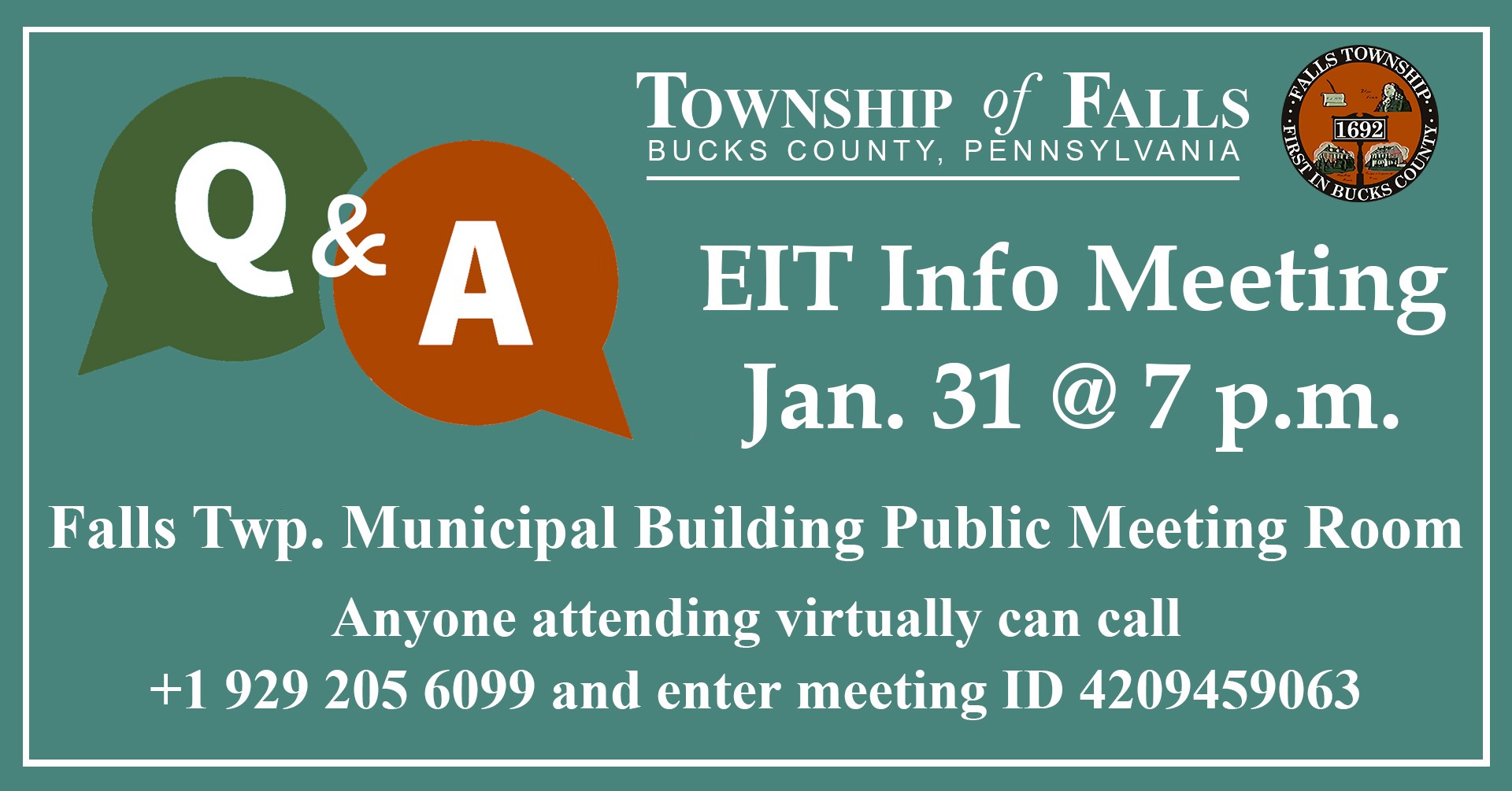

Falls Township residents with questions related to the newly enacted earned income tax (EIT) can have their questions answered during an information session on Jan. 31.

Set for 7 p.m. at the Falls Township municipal building, 188 Lincoln Highway, residents will be able to participate in-person or via zoom. The meeting will also be televised and posted to the Falls Township website. Those wishing to participate virtually can call +1 929-205-6099 and enter meeting ID 4209459063.

Since the meeting was inadvertently scheduled the same day and time as the meeting to discuss the possible Pennsbury-Morrisville school merger, Falls is planning to offer a subsequent meeting if necessary.

Supervisor Chairman Jeff Dence said he was disappointed in Keystone Collections’ notification to residents regarding the EIT.

“It wreaks of a scam letter,” Dence said of the communication from the county-appointed agency for EIT collection for Bucks County municipalities.

Falls is striving to keep the community in the loop with proper information, which is why “we scheduled the first (meeting) as soon as we could,” Dence said.

Subsequent communication will be forthcoming, and Falls set up a dedicated email address where residents can send EIT-specific questions: eit@fallstwp.com.

See below for information regarding Falls Township’s EIT

FALLS TOWNSHIP

EARNED INCOME TAX

INFORMATION SHEET

Effective January 1, 2023, Falls Township has enacted a 1% Earned Income Tax (EIT) to be collected by Keystone Collections Group for the Township. Keystone Collections Group was appointed by Bucks County to collect the EIT for Falls Township. Keystone can answer questions about EIT collection, remittance, and tax return filing, and you can reach them by telephone at 724-978-0300 or go to their website at Keystone Collections Group (keystonecollects.com). Their FAQ pages should be able to answer most of your questions.

As its name implies, the Earned Income Tax (EIT) is imposed on earned income, such as wages, salaries, and net profits, but not on unearned income such as interest, dividends, capital gains, alimony, and Social Security. Also, any individual earning a total income of less than $8,000 annually is exempt from the EIT.

The EIT is imposed on both Township residents and on non-residents who work within the Township limits. The residential portion of the EIT takes precedence over the non-residential portion so that an individual who is subject to both pays their residential portion first and only pays non-residential EIT if that amount is greater than the residential amount. The major exception to this rule is Philadelphia’s Wage Tax which overrides the EIT (per the Sterling Act) so that any earned income subject to Philadelphia Wage Tax is not subject to EIT.

Excepting certain circumstances, the Local Tax Enabling Act limits the EIT to a combined total rate of 1%. Therefore, for wages not subject to the Philadelphia Wage Tax, the following scenarios would apply:

- Falls Resident (regardless of site of work) – Pays 1% EIT for Falls Township

- Non-Resident (work site in Falls Township) –

- If NR pays 1% EIT for home municipality, pays 0% for Falls Township

OR,

- If NR pays 0.5% EIT for home municipality, pays 0.5% for Falls Township

OR,

- If NR pays 0% EIT for home municipality, pays 1% for Falls Township

Pennsylvania employers are required to withhold applicable EIT from non-residents and residents and then remit all withholdings to the Keystone Collections Group. Out-of-state employers may choose to withhold and remit the EIT for PA resident employees, but if they choose not to, they should notify the PA resident employee so that the employee can make quarterly estimated payments on their own to Keystone Collections Group.